Tax Season Guide

Tax Preparer's Information

Manila Central USA Inc.

Joey Ramos, Bond No. MBS0121189, Exp. 06/15/28

Virgilio Joaquin McDaniel, Bond No. MBS0122818, Exp. 08/01/28

RLI Insurance Company. www.ctec.org

Due Diligence Information

CA FORM 3596- CTEC No. A328493 (Joey Ramos); A361026 (JR Joaquin)

Form W-2s and/or Form 1099s

Form 1098-T

Income and Expense Statement, Business Registration

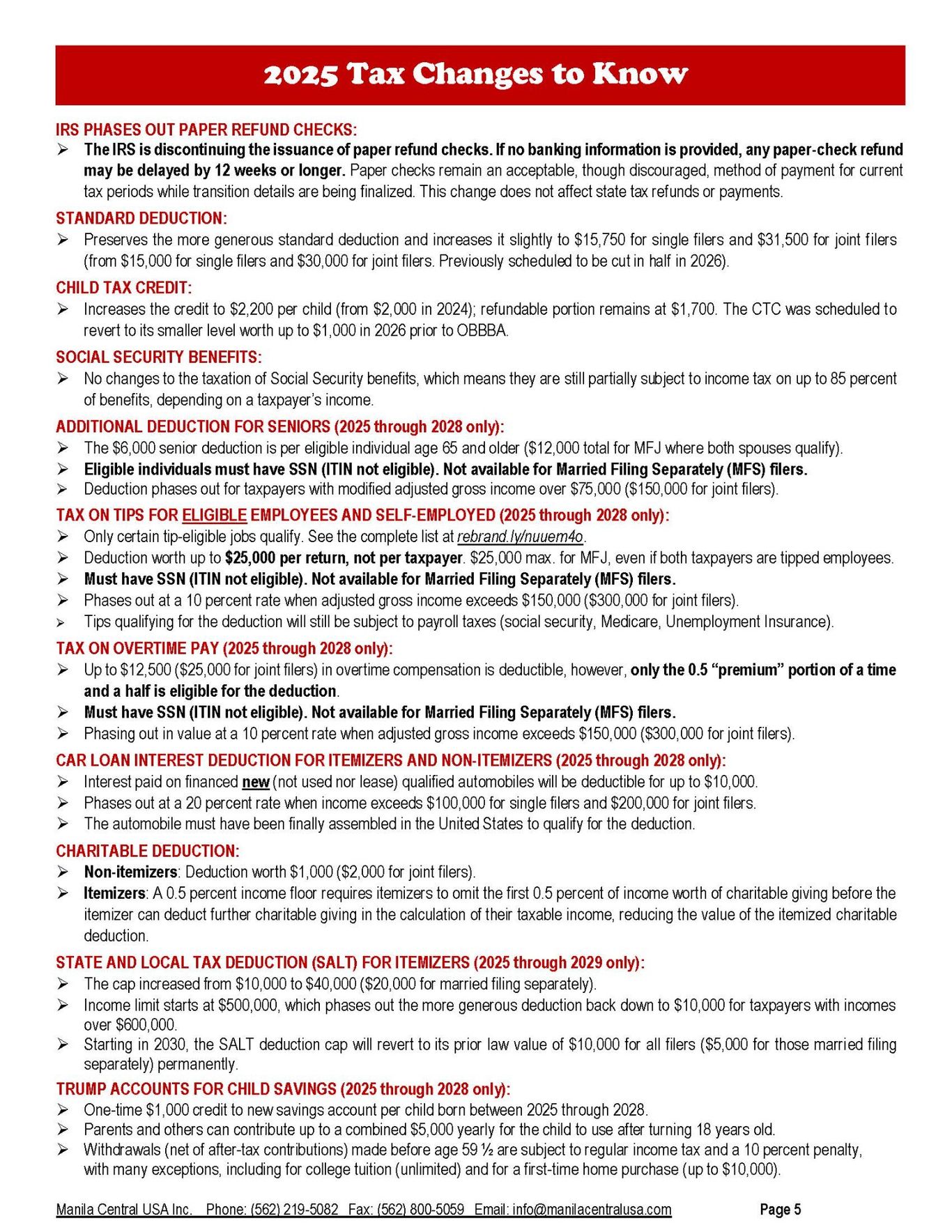

Trump Account Must-Know

Feature $1,000 Federal Seed $250 Private Donation

Source U.S. Treasury Private donors (e.g., Michael & Susan Dell)

Who Qualifies Children born 2025–2028 with SSN & U.S. citizenship Children under about age 10 meeting donor criteria

Income Test ❌ None ✔ Sometimes (e.g., ZIP-code income limits)

Age Limit Based on birth year range, not current age Based on current age (usually under 10)

Account Required Yes Yes

Amount $1,000 one-time $250 one-time (per donor terms)

When Funds Can Be Used From age 18 (tax-deferred growth) Same rules apply

Need to Open Account by Mid-2026 launch Before deposit is made

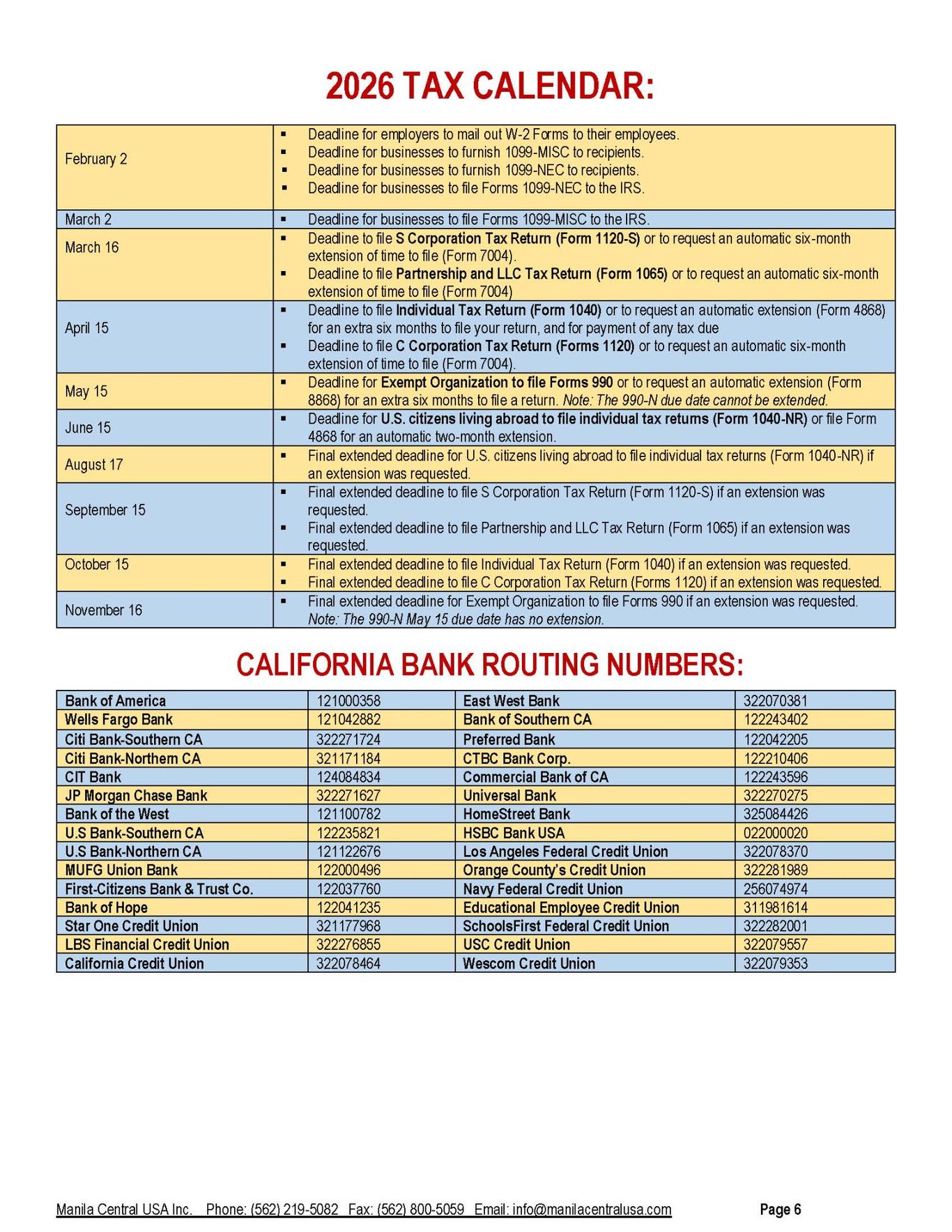

Tax Deadline Extensions

TY 2022- tax filing deadline postponed to November 16, 2023, for 55 of California's 58 counties (except Lassen, Modoc and Shasta counties).

Federal: FEMA-3591-EM

CA State: Code 141: Severe Winter Storms

Learn more: https://www.irs.gov/newsroom/for-california-storm-victims-irs-postpones-tax-filing-and-tax-payment-deadline-to-nov-16

TY 2024- tax filing deadline postponed to October 15, 2025, for LA county.

Federal: FEMA-4856-DR. Call 866-562-5227 to have the penalty abated.

CA State: Code 157: LA Fires & Windstorm. Call 888-825-9868 to have the penalty abated.

Learn more:

https://www.irs.gov/newsroom/irs-announces-tax-relief-for-taxpayers-impacted-by-wildfires-in-california-various-deadlines-postponed-to-oct-15

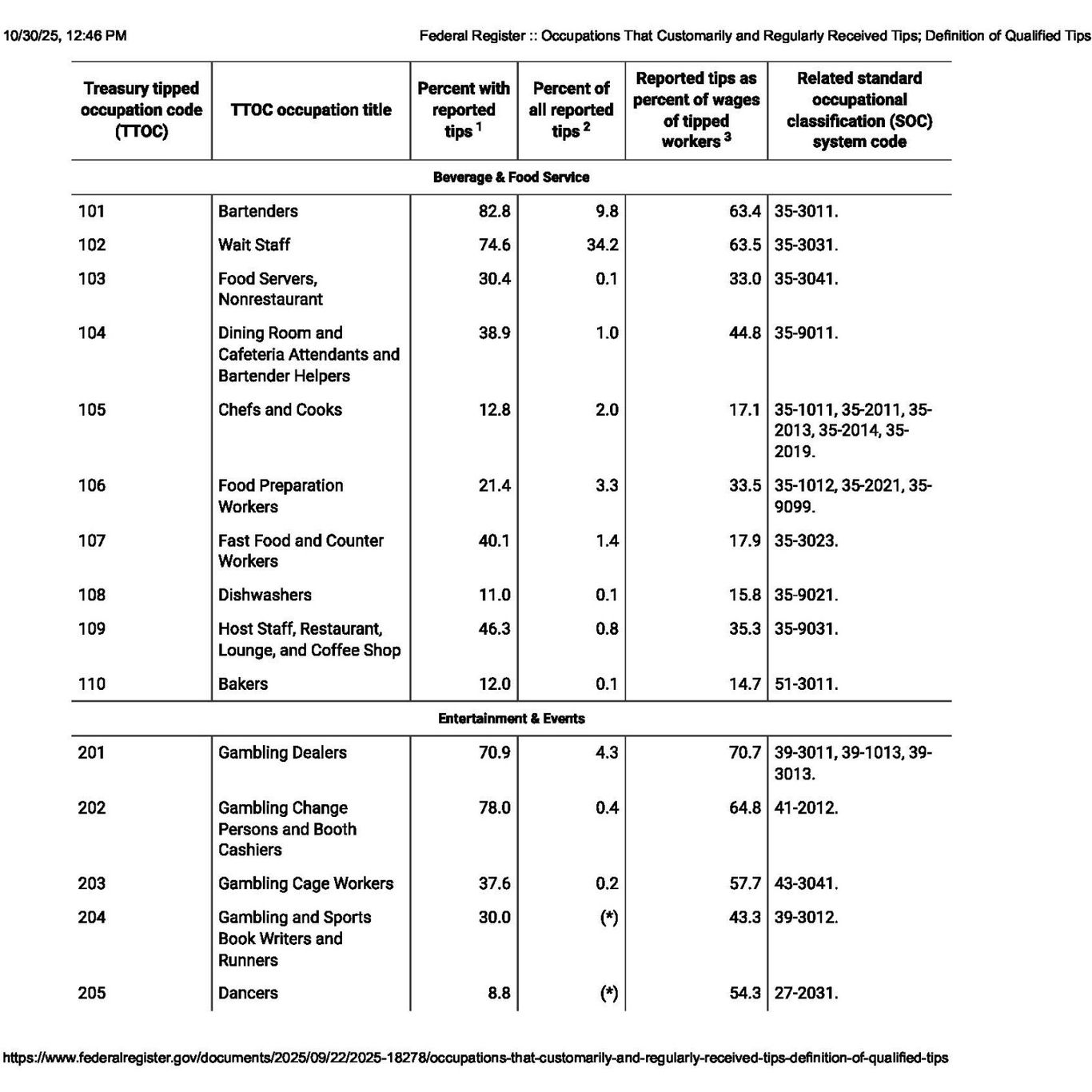

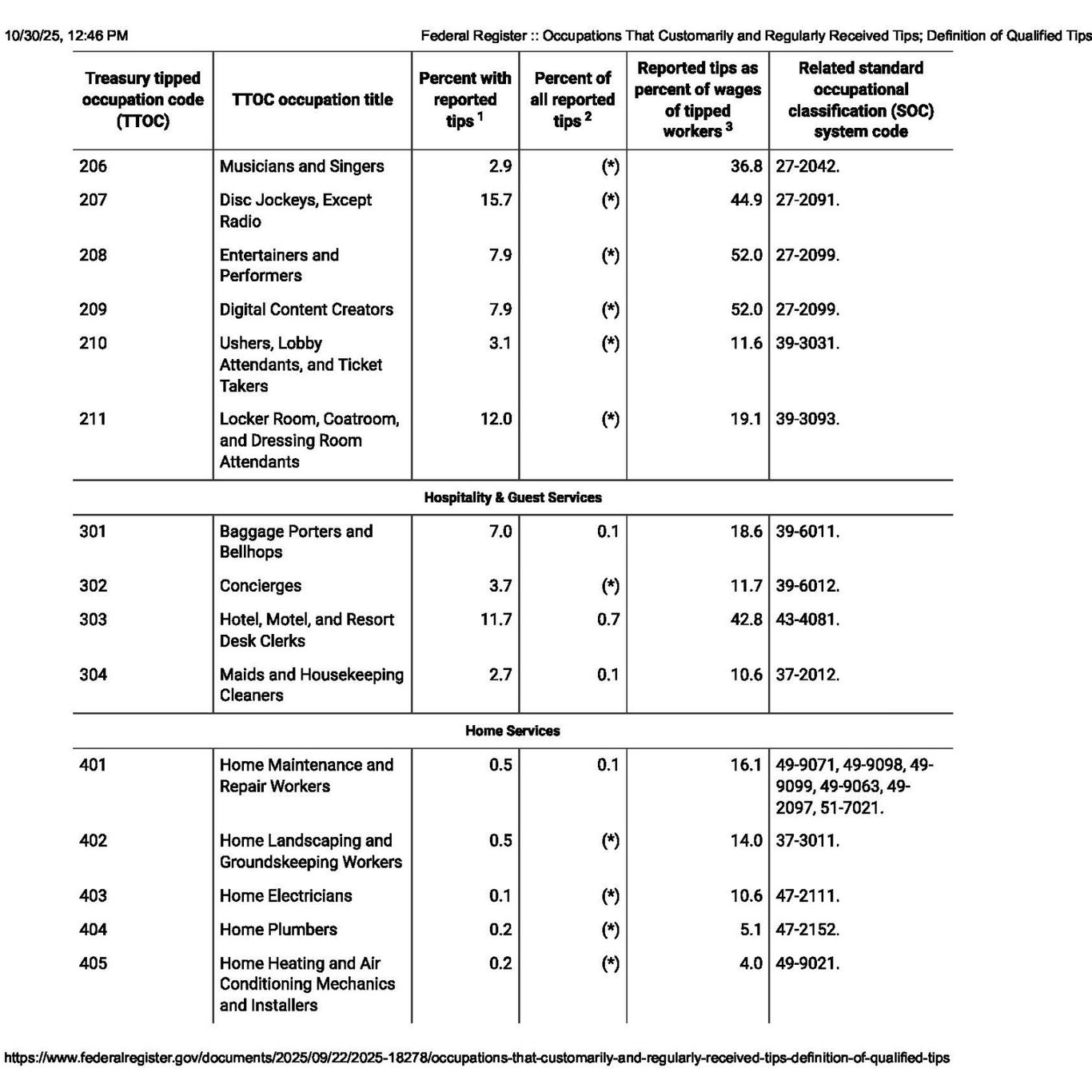

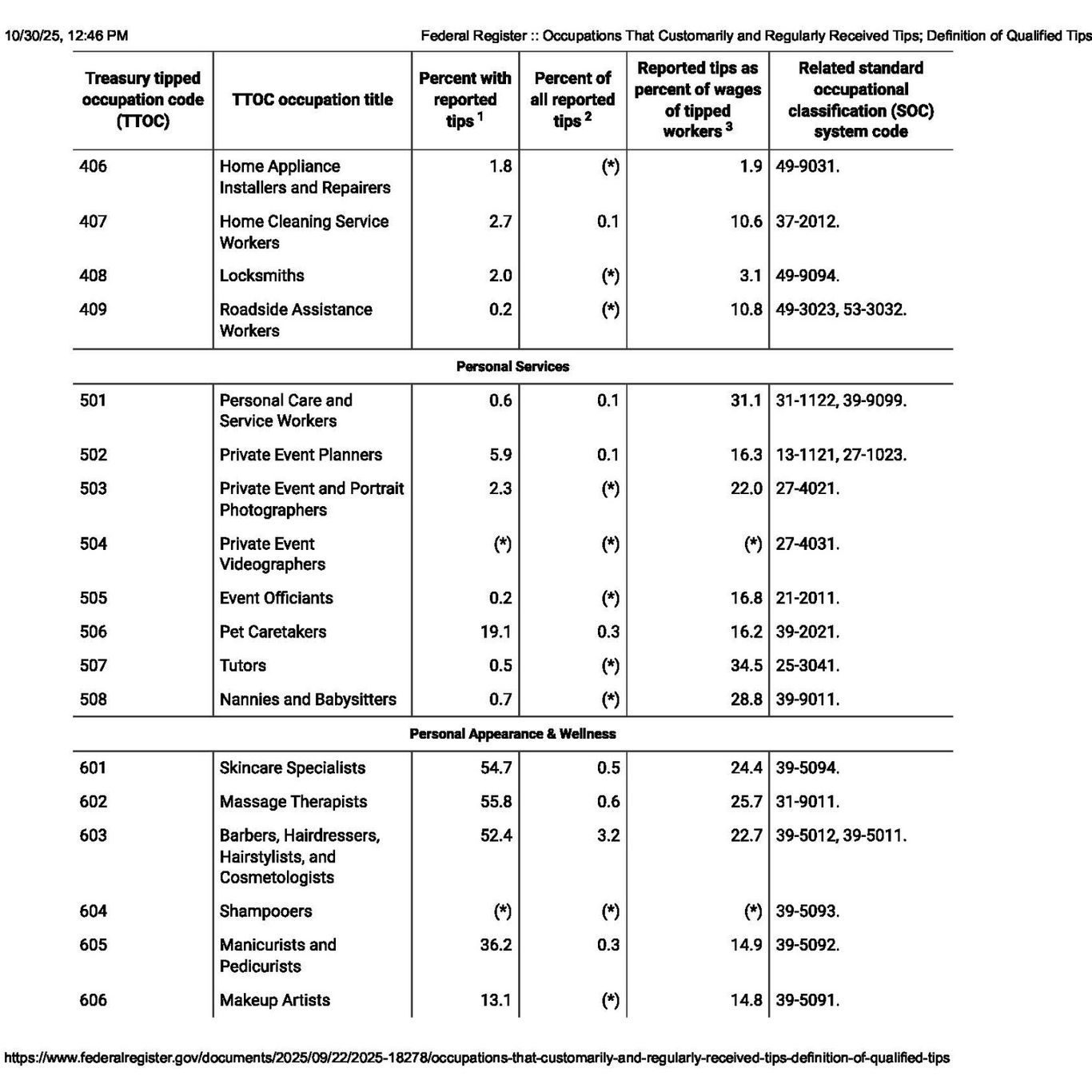

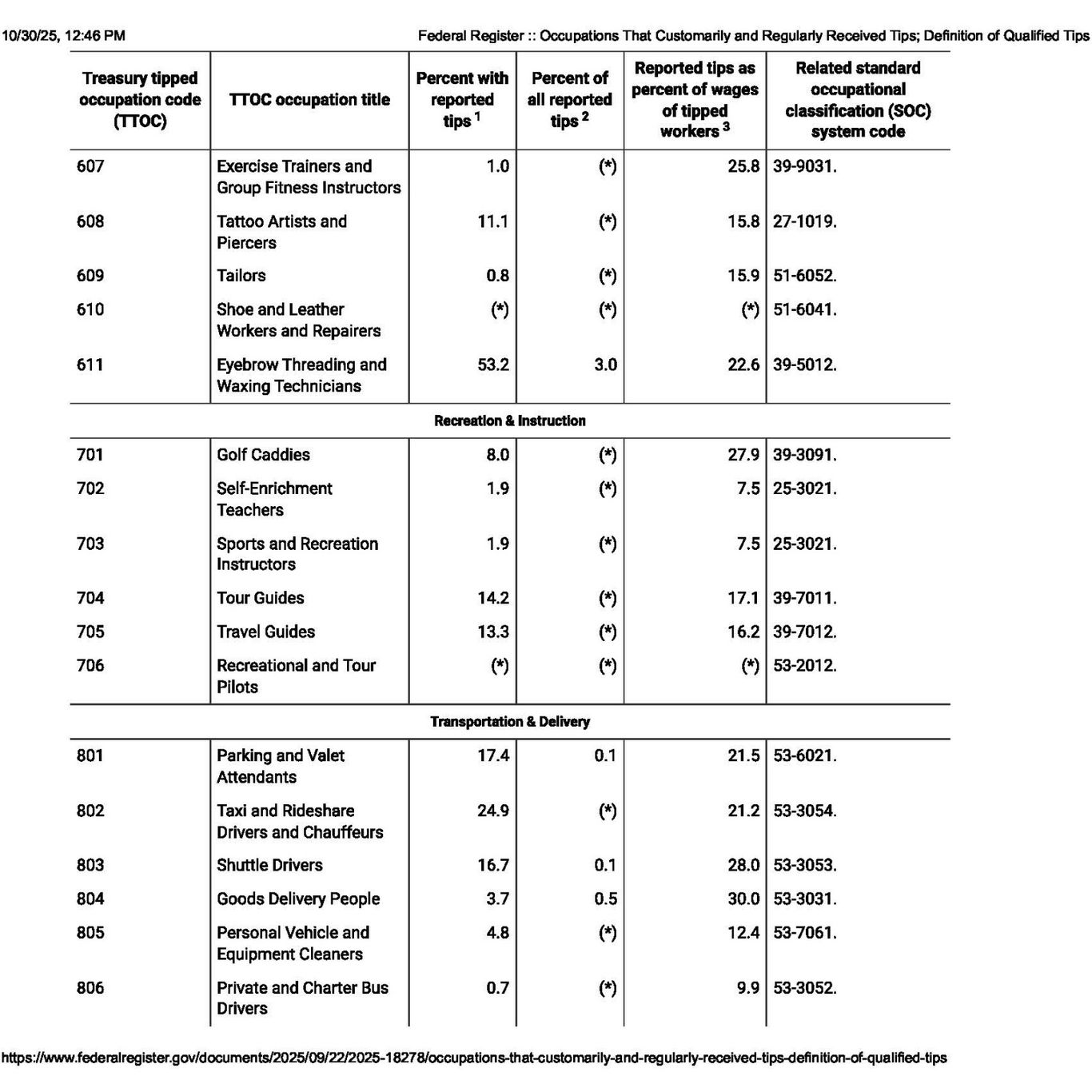

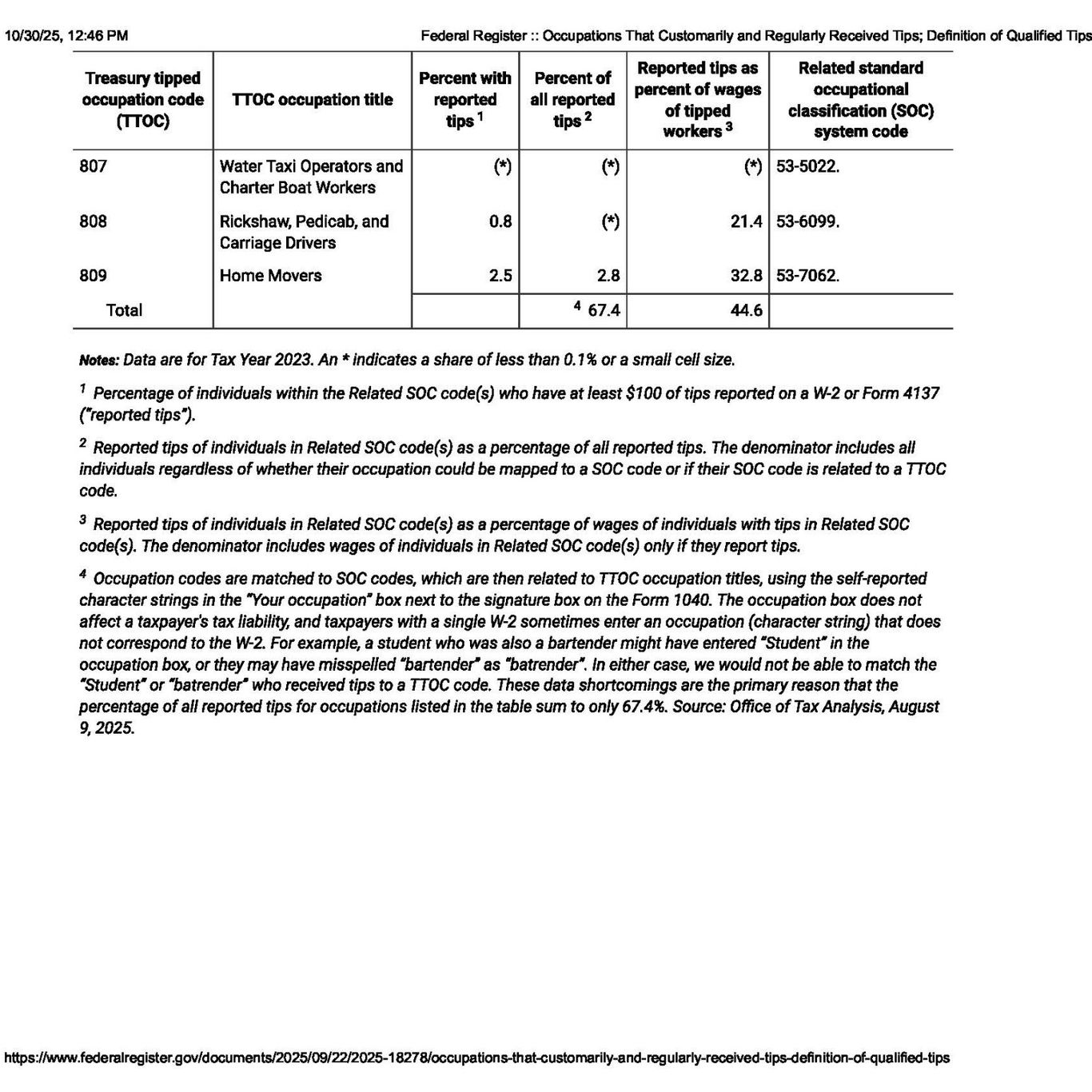

What jobs are eligible for no tax on tips?

The IRS has created a Treasury Tipped Occupation Code system to organize jobs into categories. Each category is assigned a three-digit code, and the proposed list groups the occupations into eight main categories. See rebrand.ly/nuuem4o: